07 Aug Tax Benefits Fund Facility Improvements

Business owners and property managers seek out innovative means to mitigate operation and maintenance costs during extraordinary circumstances. They can accomplish both goals by upgrading the existing lighting and controls system in their facility. Modern LED technology and controls can reduce lighting energy costs by more than 60% and virtually eliminate lighting maintenance costs for the next decade or more. Lighting upgrades can be a significant investment but there are several programs in place to assist in funding their implementation. Utility company rebates and incentives are available to help reduce cost, and the resulting energy savings offset the investment over time. Property owners may also consider Lighting as a Service (LaaS) options. LaaS mimics popular subscription or leasing models used in video streaming and office equipment such as copiers, but for your lighting system. Property owners and managers can effectively receive a free upgrade to their lighting experience using money saved on energy costs to cover the monthly payment on the new lighting system purchase. Lastly, recent amendments to the code could include tax benefits to help pay for facility improvement projects including lighting, electrical, and controls systems.

2020 CARES Act Includes Tax Benefits for Qualifying Facility Improvement Costs

Thanks to provisions in the 2020 Coronavirus Aid, Relief, and Economic Stability (CARES) Act, the best time to upgrade the lighting and other electrical equipment in your non-residential space is right now. The Tax Cuts and Jobs Act (TCJA) in 2017 eliminated specific definitions for some qualified improvement property (QIP) under IRC Section 168(e)(3)(E), resulting in a failure to provide certain qualifiers for depreciation bonuses. Prior to the 2020 CARES act provision, QIP purchased in September 2017, and installed starting January 2018, was placed on a 39-year recovery schedule and ineligible for bonus depreciation. However, the 2020 CARES Act remedied that oversight and now allows you take the full deduction of certain project costs in a single year. Qualifying non-structural upgrades to an interior building space may include, but are not limited to:

- Interior lighting fixtures and lamps

- Lighting sensors and controls

- Harmonic filters

- Electrical upgrades

- Air circulation fans

- Building management systems

What Does This Mean for Facility Owners and Property Managers?

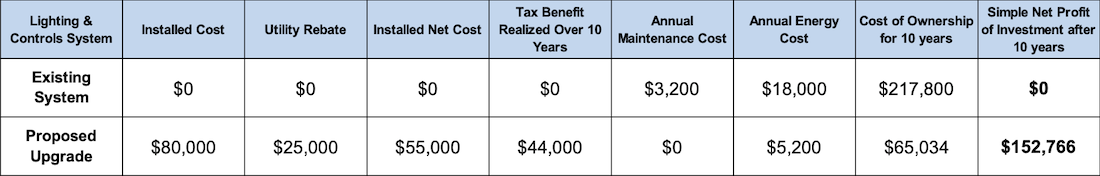

Owners and managers of healthcare, office, commercial, and industrial spaces may be advantageously positioned to reap the benefits of the 2020 CARES Act amendment to the QIP. They may invest immediately in upgrades to lighting, controls, and electrical systems that may have already been on their long-term facility improvement schedule. Associated costs are offset by generous utility rebates, energy savings, leasing models, and/or tax benefit realizations. The tax benefit outlines no top-end limitation on the investment, so a facility-wide, holistic energy improvement approach could be realized. As an example, a facility that includes a warehouse and office spaces wishes to upgrade their lighting and controls. That upgrade costs $80,000 but earns a utility rebate of $25,000, so the net investment is $55,000. Once the energy and maintenance savings and tax benefit are factored in, that investment results in a simple net profit of over $152,000.

Energy Improvements are a Long-Term Strategy

Facility owners and managers generally have an exceedingly long list of planned improvements. Those can be anything from cosmetic upgrades such as paint and flooring to security upgrades like cameras and access doors. The good news is that lighting and controls improvements result in reduced energy costs, yielding positive cash flow. Those savings can then be applied to other improvement projects that produce more intangible results. Or better yet, savvy owners and managers may choose to invest in measures that future-proof their facility, such as electric vehicle (EV) charging stations and solar panel systems. Lumenal Lighting can help you with those endeavors, as well.

Citations

- EY Tax News Update – Broad procedural guidance for implementing CARES Act provisions on qualified improvement property

- Shearman & Sterling – IRS Guidance Clarifies CARES Act Relief Procedures for Partnerships

- Lumenal Lighting – Lighting as a Service Richly Benefits Businesses

- Lumenal Lighting – EV Charging Stations Attract Valuable Commercial Property Tenants.

Last Modified: August 7, 2020